With the rise of financial giants like BlacRock, Bitcoin has never been so concentrated. The capture of Bitcoin by a few large wallets, as well as the professionalization of mining companies, contribute to the dangerous concentration. With each halving, this trend is more pronounced.

“ Bitcoin because fucking banks ”, could perfectly sum up the anti-systemic spirit of Bitcoin. Taken over Bitcoin magazine to illustrate the subversive nature of cryptocurrency, the term is quite popular among BTC defenders. If destroying Bitcoin is now impossible, hijacking it to damage it from the inside seems much more realistic.

Decentralization: Bitcoin’s Political Utopia

Decentralization—or should we say deconcentration, to separate the technology from its use—has always been at the heart of Bitcoin’s political project. Create a native internet currency, without a trusted third party and uncensorable: electronic cash 100% independent of institutions. Anti-bank utopia, which is a continuation of the work of crypto-anarchists (or cypherpunks).

These radical and fringe computer scientists with libertarian leanings have been active in the United States since the 1990s. They were an important source of inspiration for Satoshi Nakamoto, whose complete anonymity was essential to the decentralization and survival of the Bitcoin network, which was unassailable because it had no leader.

Thanks to the blockchain and the proof of work mechanism, Bitcoin managed to bypass banks and states. At least for a while. Because after 15 years of existence, what is “punk” left in Bitcoin? At a closer look, the Bitcoin market is increasingly resembling a classic stock market, driven by the appetite and greed of the big financial players.

“Whales”, extremely rich in bitcoins

First come first served. This could be the philosophy of the lucky ones who invested early when Bitcoin was barely worth a few dollars. These early investors were able to acquire hundreds if not thousands of digital tokens.

So Bitcoin also has its ultra-rich. In slang, they are called “whales”. These big fish have a major impact on the price of Bitcoin and its ecosystem. They are installed at the top of the food chain and are accused of knowingly manipulating the price of the first cryptocurrency. Whale-alert.io lists these particularly well-stocked digital wallets.

Major Bitcoin owners include prominent Silicon Valley billionaires. Michael Saylor, founder of MicroStrategy, so he only holds 17,000 bitcoins. Jack Dorsey, another tech mogul known for co-founding Twitter, is also real bitcoin evangelist. He had $50 million in bitcoins purchased through his company, Square. As for Elon Musk, it is SpaceX and Tesla that are invested in BTC: a total of 20,000 are held in the form of capital.

But the biggest whale of all is Satoshi Nakamoto. Virtually the owner of a fortune estimated at more than 1 million bitcoins, the bitcoin creator is heavy. the equivalent of $66 billion, which theoretically ranks him among the 20 richest people in the world.

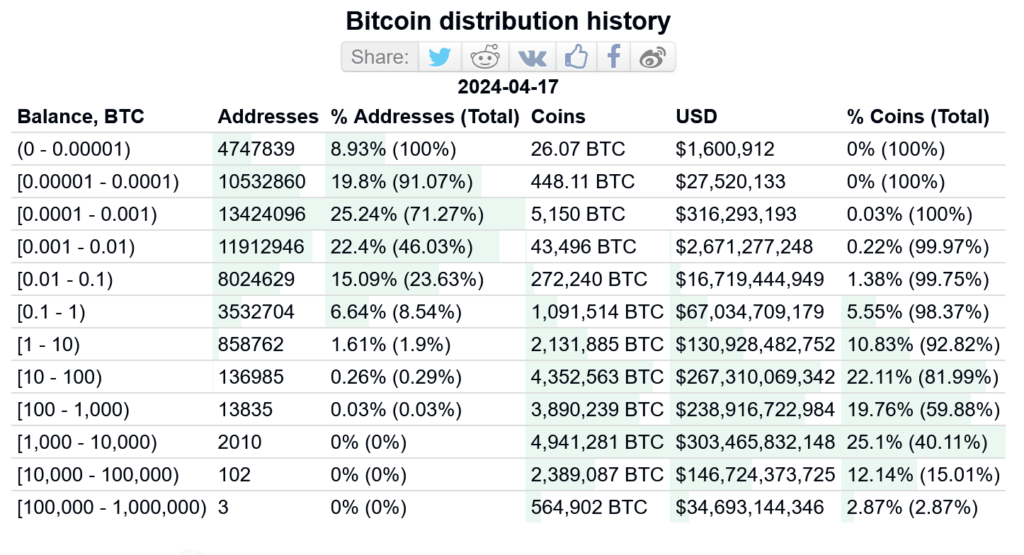

Bitcoin concentration is not a new phenomenon. In 2021, 2% of network entities controlled 71.5% of all bitcoins, according to Glassnode, while Bloomberg estimated the number at 95% using a different method. While no one agrees on the exact numbers, they all show that a significant portion of Bitcoin is indeed concentrated in the hands of a few entities.

Although in reality, Bitcoin is still more decentralized than it was in 2010, when a handful of individuals held 100% of the digital tokens.

Problematic concentration

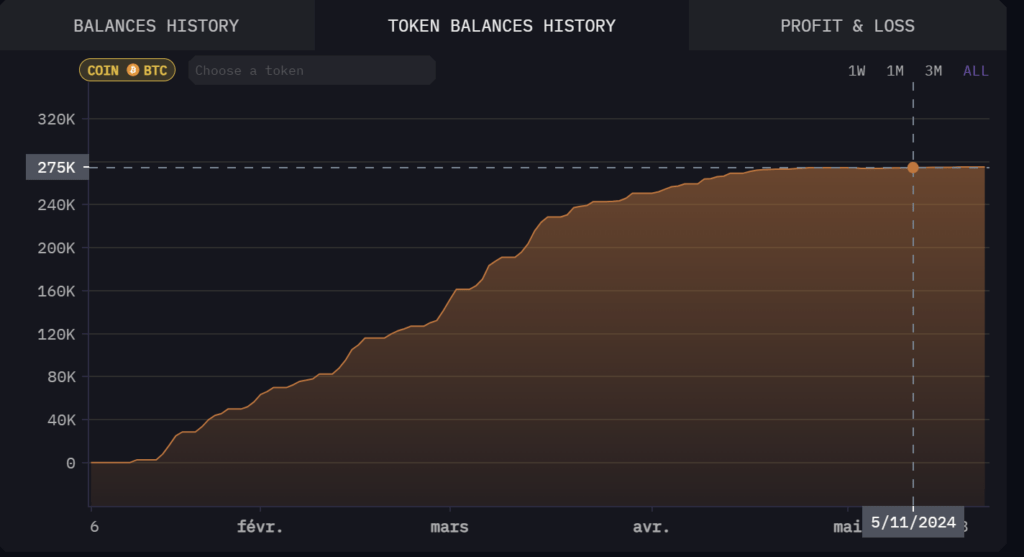

The flip side of Bitcoin’s success is that it has been gradually colonized by financial institutions. In early 2024, BlackRock entered the race by launching a Bitcoin ETF. Within a few months, the largest management company in the world got its hands on 275,000 BTC. Ironically, these repeat purchases could give Bitcoin the boost it needs to finally reach $100,000. Despite the euphoria, however, a section of the Bitcoin community fears that the worm is already in the apple and regrets that finance has begun to corrupt Bitcoin.

Another threat to Bitcoin decentralization comes from platforms like Binance or Bitfinex. These crypto banks hold cryptocurrencies on behalf of their clients for a few fees.

Nothing that visibly worries the millions of users who trust them to keep their cryptocurrencies warm instead of doing it themselves at the risk of losing their funds. But the recent FTX affair has shown that these companies can fail, or even go bankrupt. A philosophy at odds with Bitcoin’s original promise, deeply anti-central authority.

Mining Centralization: A Growing Threat to Bitcoin

The problem is that now these platforms are both judge and party. This is the case of Binance, which since 2020 has combined its activities with Bitcoin mining. The same company that is accused of unfair practices in France.

Mining is the core of the Bitcoin protocol, which is necessary for the blockchain to function properly. Mechanically, it leads to competition between miners. The consequence: the least profitable are eliminated, which tends to create monopolies. However, with the gradual halving, which cuts miners’ reward in half, the noose is getting tighter and tighter. This mechanism requires increasing sophistication of mining machines and creates a market within the market. Manufacturers then have to use graphics cards specially designed for mining, ASICs. Mining is being industrialized.

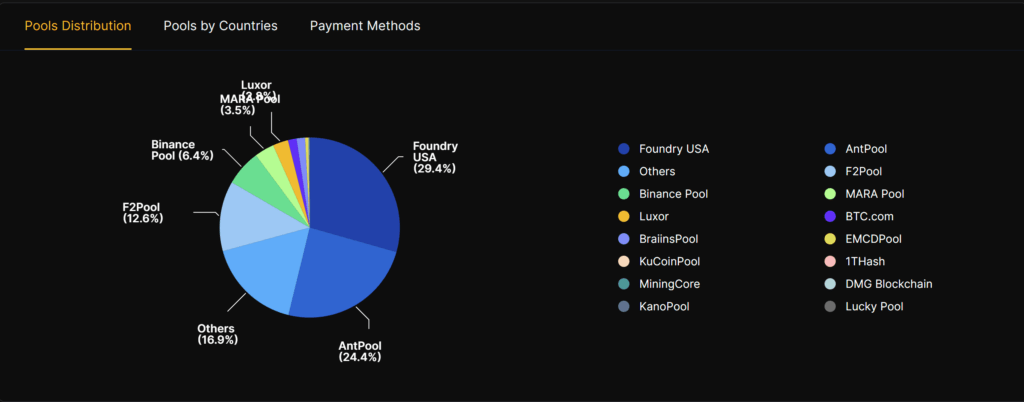

2 companies mine 50% of bitcoins themselves

Far from geeks years ago motivated by the idea of currency peer to peer Today’s miners are seasoned entrepreneurs who are concerned about their profitability. They are now organized in mining pool, types of virtual cooperatives. They thus increase their chance of winning by sharing their computing power. In 2021, a National Bureau of Economic Research study provided an overview of this centralization: 0.1% of miners were responsible for half of the world’s bitcoin production.

Today, two companies, Foundry USA and AntPool, share most of the pie. Controls more than 50% of computing power mining pools, threatening the decentralization of the network. However, there is a critical threshold that must not be exceeded, and this is precisely set at 50% of the computing power. The above bitcoins could (theoretically) be hacked if the actors colluded to damage the network. But above all, these pools add centralized intermediaries. So much so that Bitcoin transactions become easily censorable.

Foundry USA displays this sales-y but paradoxical line on its website: “ We’re not waiting for a decentralized financial future, we’re building it now.” An example of Bitcoin’s double play, which has always been torn between its promises of decentralization and the growing appetite of traditional financial players for the cryptocurrency market.

Subscribe for free to Artificielles, our AI newsletter, designed by AI, verified by Numerama!