Indeed, this increased activity indicates bullish sentiment among institutional investors, which may cause BTC to reach new highs.

An influx of bitcoin ETFs could boost prices

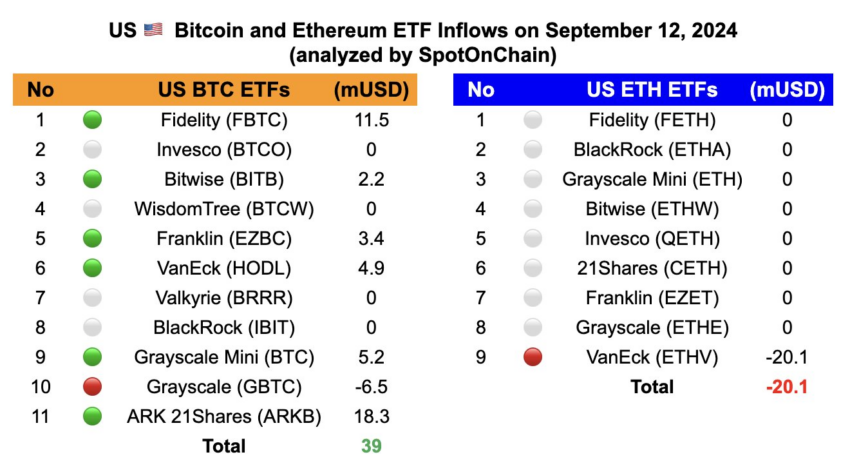

Analysts at SpotOnChain reported significant inflows into Bitcoin ETFs. Bitcoin net flow turned positive, with an inflow of $39 million, reversing previous lower volumes.

In contrast, Ethereum ETFs saw net outflows for the second day in a row, with withdrawals of $20 million for Grayscale’s ETHE, while other US ETH ETFs had no net inflows.

More: How to Invest in a Bitcoin ETF?

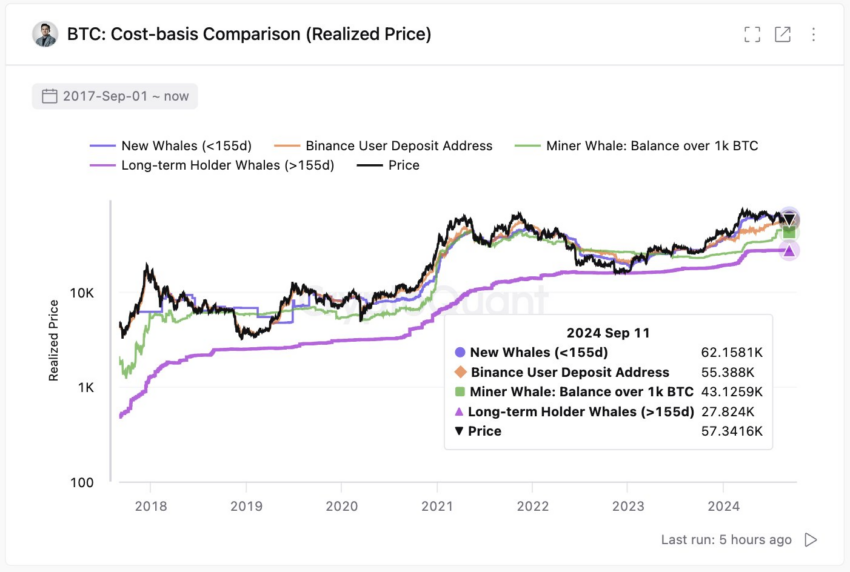

Positive inflows occur when the cost basis of investors in Bitcoin ETFs turns out to be higher than the price of Bitcoin. Ki Young Ju, CEO of CryptoQuant, noted that the cost base for the “New Custodial Wallets/ETF” is $62,000 while BTC is trading around $57,000.

According to David Puell, a researcher at Ark Invest, these market conditions suggest that the average ETF investor could be losing out. However, the historical perspective reinforces the potential for significant cryptocurrency upside.

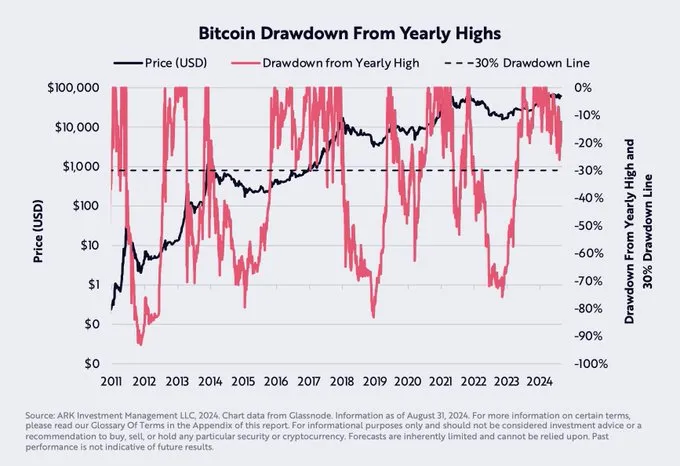

“When measured against Bitcoin’s annual highs, the percentage decline in price in 2024 still suggests the type of correction historically associated with BTC’s primary uptrends, such as those seen in 2016 and 2017,” Puell said.

The convergence of rising ETF inflows, institutional accumulation and historical patterns is contributing to consensus among analysts that Bitcoin is poised for a significant rally.

For example, Mikey Bull raised his price target for Bitcoin to $112,000, reflecting his confidence in the cryptocurrency’s potential to surpass its previous highs.

“Bitcoin has an initial target of $112,000 this year. History has indeed won. In the fourth quarter of 2016 and 2020, after the halving, we saw the start of a parabolic rally to the top of the cycle,” Bull said.

Read More: Bitcoin (BTC) Price Prediction 2024/2025/2030

Expert analysis thus highlights Bitcoin’s cyclical movements, especially after halving events, which reduce mining rewards and generally prevent price spikes. The recent surge in ETF inflows could therefore act as a catalyst influencing investment and adoption.

Moral of the story: As long as the experts believe it, so does crypto.

Disclaimer

Disclaimer: In accordance with The Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent information. This article aims to provide accurate and relevant information. However, readers are encouraged to check the facts for themselves and seek professional advice before making any decisions based on this content.